The Presidential Powers (temporary Measures) (Amendment of Reserve Bank of Zimbabwe Act and Issue of Zimbabwe Gold Notes and Coins) Regulations, 2024 (SI 60 of 2024) introduced the Zimbabwe Gold (ZiG), a new local currency for Zimbabwe, replacing the Zimbabwe Dollar (ZWL). The intention behind the introduction of the new local currency is to arrest the exchange rate volatility experienced by the ZWL and to stabilize prices.

Below is a summary of the provisions of SI 60 of 2024.

Section 2 of SI 60 of 2024: New section 44D of the Reserve Bank of Zimbabwe Act [Chapter 22:15]

- SI 60 of 2024 introduces a new section 44D to the RBZ Act. The previous section 44D of the RBZ Act introduced the RTGS$ and had been inserted therein following the promulgation of SI 33 of 2019.

- The new section 44D of the RBZ Act, as inserted by section 2 of SI 60 of 2024, empowers the RBZ to issue ZiG notes and coins, in prescribed denominations and designs.

- The ZiG notes and coins are to be issued only against reserve assets actually held and managed by the RBZ, such that the value of the ZiG issued and in circulation at one particular time shall be anchored and backed or covered by the basket of foreign currency reserves and precious metals (mainly gold) and valuable minerals held and maintained by the RBZ in its vaults as part of the in-kind royalties. See section 44D (3) of RBZ Act.

- A few comments on the new section 44D(3) of the RBZ Act :

- While the new currency is called the Zimbabwe Gold, it is, in terms of section 44D (3) of the RBZ Act, not only anchored by gold reserves but by other minerals and foreign currency reserves.

- During his monetary policy statement speech, and the inspection of the RBZ vaults by the President of Zimbabwe, the Governor of the RBZ made reference to certain gold and foreign currency reserves that are held “offshore”. However, in terms of the above provision, the ZiG can only be issued against assets “actually held and managed” by the RBZ and against a composite basket of foreign currency reserves, precious metals and valuable minerals “held and maintained by the Reserve Bank in its vaults”. The provision may be interpreted to mean that the offshore minerals or reserve assets may only be lawfully used to anchor the ZiG if they are recalled to Zimbabwe and placed in the vaults of the RBZ.

- In order to ensure compliance with the above, the new section 44D (4) of the RBZ Act provides that the RBZ’s aforementioned reserve assets would be subject to an audit at least once every calendar year, by external auditors specifically appointed for that purpose and the results thereof would be published in the RBZ’s Annual Report. In terms of section 36 (1) of the RBZ Act, such auditors are appointed by the Minister of Finance.

- The new section 44D (5) of the RBZ Act provides that the value of the ZiG, on the date of its initial issuance (5 April 2024), shall be equal to the value of one milligram of gold of 99% purity as determined by the spot price of gold and the prevailing interbank exchange rate.

- In practice, this translated to the following as of 5th April 2024 (the effective date):

- The value of USD1.00 = ZWL30,673.00

- The value of USD1.00 = ZiG13.56;

- The value of ZiG1.00 = USD0.074; and

- The value of ZiG1.00 = ZWL2,262.02.

- After 5 April 2024, the value of the ZiG shall be determined by the inflation deferential between the ZiG and the USD and the movement of the price of the basket of precious minerals (mainly gold) held in the reserves by the RBZ.

- The new Section 44D (6) of the RBZ Act makes the ZiG the legal tender in all transactions, alongside any other currencies accepted as such in terms of section 44A of the RBZ Act.

- A few comments on this:

- Section 44A of the RBZ Act gives the Minister of Finance the power to designate other currencies as legal tender in Zimbabwe.

- In terms that particular provision, the Minister issued SI 142 of 2019 which, in section 2 thereof, not only made the ZWL the sole legal tender in Zimbabwe but also specifically provided that the “USD, South African rand, Botswana pula and any other foreign currency whatsoever” were no longer legal tender (See also section 23 of Finance (No. 2) Act of 2019).

- In his monetary policy statement, the Governor of the RBZ seemed to suggest that the USD was legal tender. However, there is currently no legislative provision expressly providing for such, in light of the legal developments after 2019. The current position of the law is that a payer is permitted to settle his financial obligations in foreign currency (until 31st December 2030). The payee, however, does not have a right to demand payment in foreign currency, meaning that the payer may make a lawful tender of payment thereto in local currency. See section 11 (2a) of the Exchange Control Act [Chapter 22:05].

Section 3 of SI 60 of 2024: ZiG notes and Coins:

- This is a deeming provision which makes the ZiG be deemed to be prescribed in terms of section 44D (1) of the RBZ Act.

- The provision also provides that the ZiG notes will be in the denominations of ZiG1.00, ZiG2.00, ZiG5.00, ZiG10.00, ZiG20.00, ZiG50.00, ZiG100.00 and ZiG200.00.

- The issuance of ZiG coins will be prescribed on a later date, presumably in a separate statutory instrument.

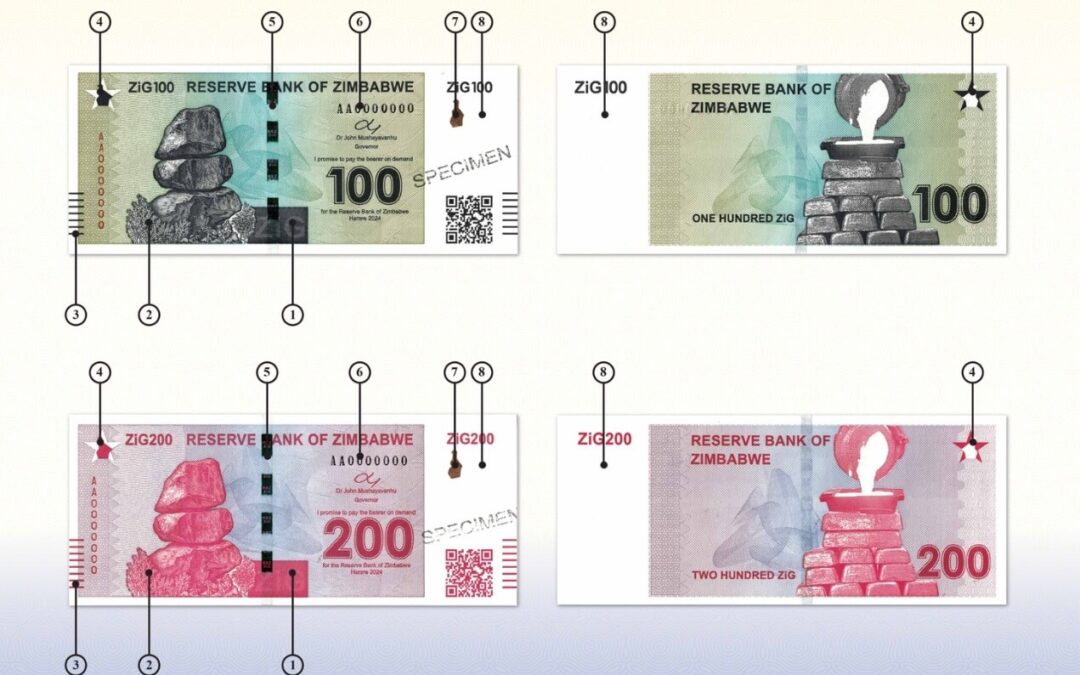

Sections 4 and 5 of SI 60 of 2024 deal with the design of the ZiG notes which will not be considered in this article.

Section 6 of SI 60 of 2024: Conversion of ZWL balances to ZiG

- The section provides that all ZWL balances held in any account with a banking institution in Zimbabwe shall, on 5th April 2024, be converted to ZiG balances using the formula provided for “in section 44D (8)”

- It must be noted that there is, in fact, no section 44D (8) in the RBZ Act. The formula for the conversion is provided for in section 44D (5) of the RBZ Act. Reference to 44D (8) must therefore, have been a typographical error.

- All circulating ZWL notes and coins are convertible to ZiG notes and coins within 21 days from the 5th April 2024, to wit, on or before 26th April 2024, in the following manner:

- For those with bank accounts, by depositing the same into their bank accounts;

- For those without bank accounts, by swapping the ZWL notes and coins for ZiG notes and coins at designated banking institutions. In his monetary policy statement, the RBZ Governor designated POSB and AFC Commercial Bank as the designated banking institutions for this purpose.

- Additionally, the Governor stated, in his monetary policy statement, that where one wishes to exchange cash above ZWL100,000.00, the banks shall apply the requisite KYC and Customer Due Diligence principles.

Section 7 of SI 60 of 2024: ZiG to be unit of Account

- The section provides that with effect from 5th April 2024, for all accounting and other purposes, including discharge of financial or contractual obligations, all assets and liabilities which were valued and expressed in ZWL immediately before that date, would automatically be values in ZiG as converted in terms of the aforementioned formula.

- The provision bears almost the exact wording as the previous section 44D (1) (d) of the RBZ Act (or section 4(1)(d) of Si 33 of 2019), which introduced the RTGS$. For that reason, in interpreting the words used therein, the previous court judgments, dealing with the interpretation of the previous section 44D of the RBZ Act, may be useful.

- As of 5th April 2024 therefore, all ZWL valued assets and obligations are, by operation of the law, now values in ZiG, converted in terms of the afore discussed formula.

Sections 8 to 11 of SI 60 of 2024 deal with amendments to statutes that referred to ZiG as meaning the Zimbabwe gold-backed digital token, issued in terms of section 7(d)(i) and 47 (3) of the RBZ Act. The gold-backed digital currency had been referred to as ZiG before the 5th April 2024. Due to the new currency being called ZiG, the Zimbabwe gold-backed digital token will no longer be using that name, although it will continue to be in circulation as a redeemable investment asset. In terms of the monetary policy statement, the Zimbabwe gold backed digital tokens will now be referred to as GBDT as opposed to ZiG.

Monetary Policy Statement: Bank Charges

- In his monetary policy statement, the RBZ Governor stated that there will be no monthly bank maintenance or service charges for individual bank accounts with a consecutive daily balance of USD100.00 and below, or equivalent in ZiG, for a period of up to 30 days.

- What this means is that for a bank account to benefit from this exemption, it must:

- Be an individual account (meaning corporate accounts are excluded);

- The bank account must, for a period of 30 consecutive days, have a balance of USD100.00 or less

- Where, for example, an individual account gets a deposit of an amount above USD100.00, during the 30 days’ period, and the owner of the account withdraws money therefrom such that the account balance returns to USD100.00 or less, such an account would be liable for bank maintenance or service charges.

Recent Comments